Understanding Cavalry SPV I LLC and Your Rights

Facing a debt from Cavalry SPV I LLC can be stressful, but understanding your options and rights is the first step toward a resolution. Cavalry SPV I LLC is a debt buyer; they purchase debts from original creditors and pursue collection. This means they may not be the original company you owed money to. Don't panic – you aren't powerless. This guide provides actionable strategies to navigate this situation effectively. Remember, this is educational information, not legal advice. Consult a lawyer for personalized guidance. For additional resources, check out this helpful guide: Financial Help.

Key Takeaway: Cavalry SPV I LLC purchases debts. Before engaging, verify the debt's legitimacy and understand your rights under the Fair Debt Collection Practices Act (FDCPA).

Did you know that many people successfully negotiate settlements with debt buyers like Cavalry SPV I LLC? It's more common than you might think.

Is This Debt Even Legitimate? Debt Validation is Your Friend

Before paying anything, verify that the debt is yours and accurate. Under the FDCPA, you have the right to request debt validation from Cavalry SPV I LLC. This means sending a written request demanding proof they legally own your debt and the amount is correct. If they can't provide this validation, you have grounds to dispute the debt, significantly strengthening your negotiating position. This simple step is often overlooked, but it's incredibly powerful.

Knowing Your Rights: The Fair Debt Collection Practices Act (FDCPA)

The FDCPA protects you from abusive debt collection practices. Cavalry SPV I LLC, like all debt collectors, must follow the FDCPA. This means they can't harass you with repeated calls at odd hours, use deceptive tactics, or contact you in prohibited places (e.g., your workplace without your permission). If they violate the FDCPA, document everything – dates, times, content of communications – as this evidence is vital if you need to take further action.

Quantifiable Fact: The FDCPA significantly limits how debt collectors are allowed to contact you. Understanding these limitations is key to protecting yourself.

Negotiating a Settlement: Your Path to Debt Resolution

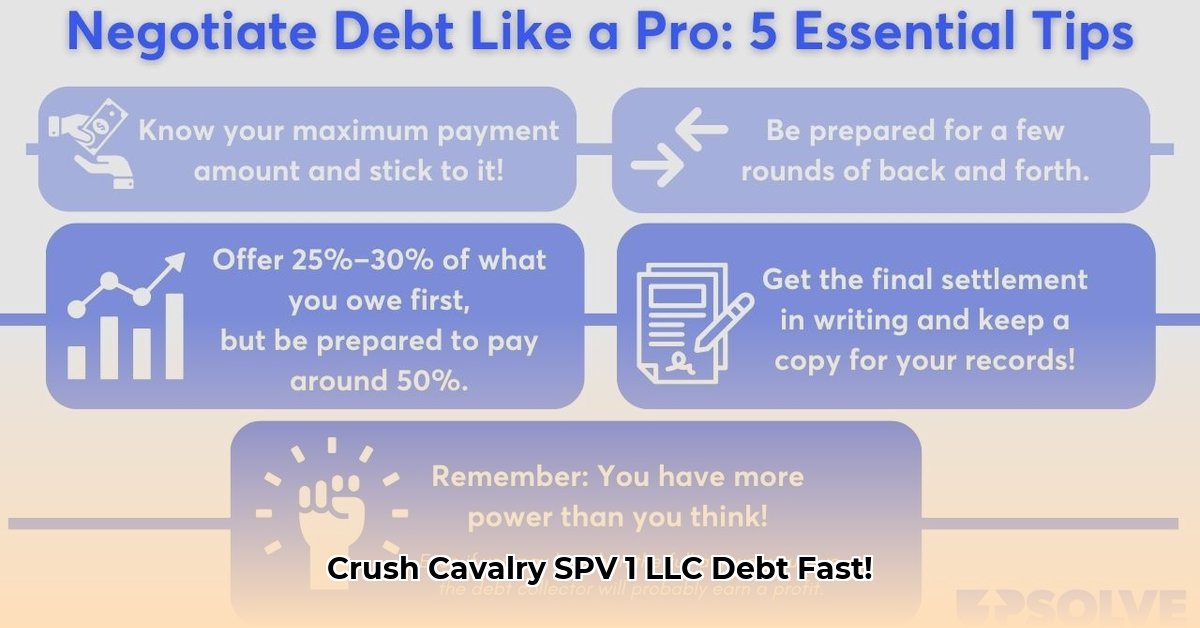

Negotiating a debt settlement means agreeing to pay less than the total amount owed in exchange for complete debt forgiveness. This strategy often leads to substantial savings. Here’s a step-by-step approach:

Assess Your Finances: Determine how much you can realistically afford to pay monthly. Your financial capacity is your leverage in negotiations.

Gather Financial Documents: Collect bank statements, pay stubs, and other financial records to support your negotiation. Preparation is paramount.

Make a Reasonable Offer: Starting with a conservative, yet realistic, offer is advisable. Be prepared to counter-offer. Researching similar settlements can provide valuable insight.

Secure Everything in Writing: A written settlement agreement is non-negotiable. Verbal agreements are unreliable. The agreement must specify the payment terms and confirm it settles the debt entirely.

Expert Quote: "A written settlement agreement offers vital protection for consumers," says Sarah Miller, Consumer Advocate, National Consumer Law Center. "It provides clear terms and avoids future disputes."

What if Cavalry SPV I LLC Sues? Your Legal Defenses

If sued, don't ignore it. Respond promptly. Each state has a statute of limitations on debt collection—a time limit on how long a collector can pursue legal action. Find your state's statute of limitations. If the debt is older, they may not be able to sue you. Consult a lawyer immediately.

Your Action Plan: A Step-by-Step Guide

Verify the Debt (Immediately): Request debt validation in writing. This could invalidate the debt entirely.

Understand Your FDCPA Rights (Immediately): Familiarize yourself with your consumer rights. This protects you from unfair practices.

Negotiate a Settlement (Within 30-60 days): Contact Cavalry SPV I LLC and propose a settlement. Aim for substantive debt reduction.

Meticulously Document Everything (Ongoing): Keep detailed records of all communications. This is crucial for potential legal action.

Seek Legal Advice (As Needed): Consult a lawyer if you have difficulty or are facing legal action. Professional guidance ensures your rights are protected.

Rhetorical Question: Wouldn't it be empowering to take control of your debt situation and achieve a favorable resolution?

Remember, proactive steps, coupled with a solid understanding of your rights, significantly improve your chances of successfully resolving your debt with Cavalry SPV I LLC. Take control and act today.